The real estate market in Delhi NCR is constantly evolving, influenced by government policies, infrastructural development, and market demand. In 2025, the focus is on affordable housing, luxury developments, and commercial real estate expansion. This guide explores key trends, investment hotspots, upcoming projects, financing options, and more.

Market Overview: Trends in Delhi NCR Real Estate (2025)

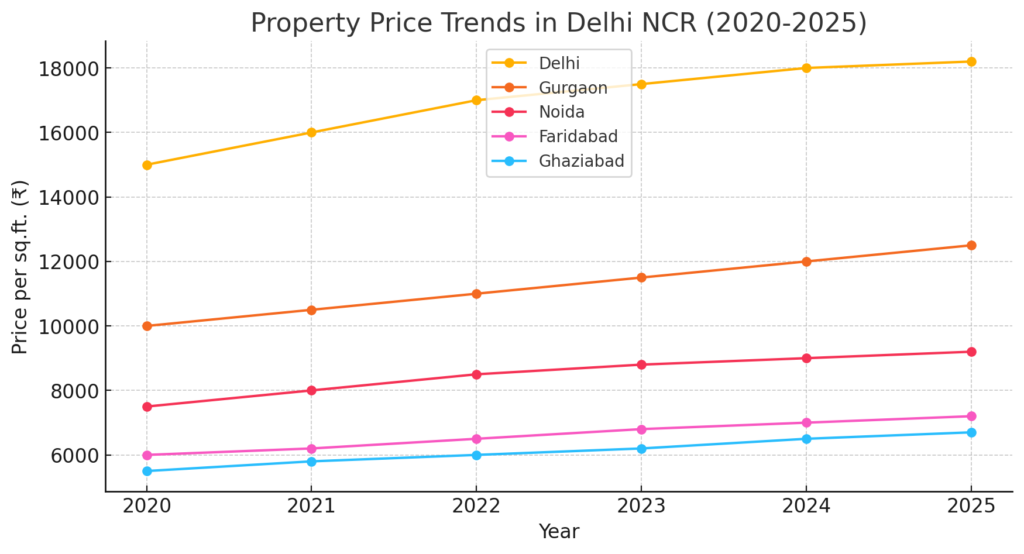

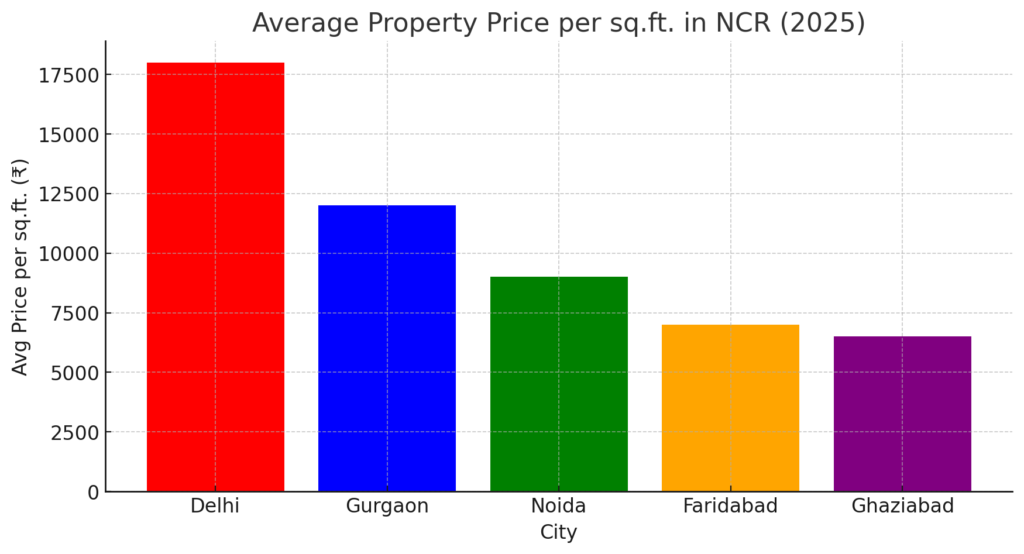

Property Price Trends in Delhi NCR (2025)

The Delhi NCR real estate market continues to evolve, with each region witnessing unique trends influenced by infrastructure development, demand-supply dynamics, government policies, and economic growth. Here’s a deep dive into the price movements and investment trends across the major cities in Delhi NCR:

1. Delhi: High Demand in Prime Areas, Stabilization Expected

Current Trends

- Premium and Ultra-Luxury Segment: South Delhi (Vasant Vihar, GK, Hauz Khas) and Lutyens’ Zone continue to command high prices, with properties ranging from ₹30,000 to ₹80,000 per sq. ft.

- Resale Market Surge: Limited new inventory has pushed demand for resale properties, especially in posh colonies.

- Central & New Delhi: Areas like Connaught Place, Chanakyapuri, and Karol Bagh are experiencing steady appreciation due to commercial expansion.

- Affordable Pockets: North Delhi (Rohini, Pitampura) and parts of West Delhi are attracting mid-segment buyers due to improved metro connectivity and infrastructure upgrades.

Key Influencing Factors

- Infrastructure Growth: The Delhi Metro Phase IV expansion and arterial road developments are making lesser-known areas more accessible.

- Luxury Redevelopment Projects: Builders are redeveloping old bungalows into luxury apartments, increasing property valuations.

- Rent Market Impact: High rental yields (4-5% in premium locations) are making Delhi attractive for investors.

Future Outlook (2025-26)

South & Central Delhi will see minor price corrections due to already high saturation.

Periphery areas (Dwarka, Najafgarh, Narela) are set to grow due to large-scale land pooling projects.

Rental demand in commercial areas will remain high, supporting price stability.

2. Gurgaon: Luxury and Commercial Expansion Driving Growth

Current Trends

- Luxury Property Boom: DLF, M3M, and Godrej-led developments are driving up prices, especially in Golf Course Road, Sohna Road, and Cyber City. Prices range from ₹15,000 to ₹40,000 per sq. ft.

- High Returns in Commercial Properties: Sectors 29, 42, and 48 have seen 20-30% appreciation in Grade A commercial office spaces.

- Upcoming Residential Hubs: Dwarka Expressway (Sector 102-113) and New Gurgaon (Sector 82-95) are emerging as high-growth corridors.

Key Influencing Factors

- Metro & Rapid Rail Expansion: Gurgaon’s connectivity to Delhi and the upcoming RRTS (Delhi-Gurgaon-Alwar) will increase demand in newly developed sectors.

- NRI & HNI Investments: A large chunk of luxury property buyers are NRIs and high-net-worth individuals (HNIs) looking for high-end residential options.

- Co-working & IT Hub Growth: Gurgaon remains India’s top office space market, ensuring high residential demand.

Future Outlook (2025-26)

Luxury prices will continue rising as demand for gated high-end communities grows.

Affordable housing sectors (Sector 37, 58, and beyond) will see an increase in first-time home buyers.

Commercial real estate in Cyber City and Golf Course Extension will continue appreciating due to increased corporate demand.

3. Noida & Greater Noida: Affordable Yet Rapidly Growing Markets

Current Trends

- Metro & Expressway Expansion: Jewar Airport, Noida Metro Phase II, and FNG Expressway are major growth drivers.

- Mid-Segment Housing Demand: Sectors like 150, 137, 79, and Greater Noida West offer properties at ₹5,000 to ₹9,000 per sq. ft., making them attractive for mid-income buyers.

- IT & Education Hub Boost: Noida’s IT sector (Sector 62, 125) and top universities are pushing rental demand.

Key Influencing Factors

- Jewar International Airport Impact: Property prices near the airport (Jewar, Yamuna Expressway) have risen 20-25% in 2024 and will continue upward.

- Affordable Housing Policy: Greater Noida and Noida Extension remain affordable due to government-backed projects.

- Co-living & Rental Market: High student and IT workforce presence supports long-term rental investments.

Future Outlook (2025-26)

Jewar-Yamuna Expressway corridor will see a price boom, especially in commercial plots.

Sectors near metro connectivity will appreciate faster than others.

Luxury apartments in Noida will attract more buyers as developers target premium segments.

4. Faridabad: Emerging Investment Destination with Industrial Growth

Current Trends

- Affordable Yet Growing Market: Faridabad remains one of the most budget-friendly real estate destinations in NCR, with property rates between ₹3,500 – ₹7,000 per sq. ft.

- Metro Expansion & Connectivity: Delhi-Mumbai Industrial Corridor (DMIC) and Metro extensions are driving investor interest.

- Government’s Smart City Push: Increased investments in sewage, roads, and infrastructure projects make Faridabad more attractive.

Key Influencing Factors

- Proximity to South Delhi: Many buyers unable to afford South Delhi are choosing Sector 75-89 in Faridabad.

- Industrial Growth: The Prithla industrial area and Ballabgarh are attracting large-scale employment, boosting housing demand.

- Upcoming Infrastructure: The KGP Expressway and new metro links will enhance livability.

Future Outlook (2025-26)

Prices will rise moderately, making it a good long-term investment option.

Sectors 75-89 will see high appreciation due to commercial hubs.

Metro & Smart City initiatives will be key factors in driving demand.

5. Ghaziabad: Affordable Housing & High Rental Yields

Current Trends

- Affordable Yet Rapidly Appreciating Market: Ghaziabad offers housing in the range of ₹3,000 – ₹6,500 per sq. ft., making it ideal for budget buyers.

- Metro & RRTS Corridor Growth: Sectors near Indirapuram, Vaishali, and Raj Nagar Extension are witnessing steady demand.

- Upcoming Infrastructure: The Meerut Expressway, Rapid Rail Transit System (RRTS), and new township projects are driving real estate demand.

Key Influencing Factors

- Delhi NCR Work-from-Home Buyers: Many professionals are relocating to Ghaziabad for affordable homes with good connectivity.

- Rise of Co-living Spaces: Indirapuram and Vaishali are major co-living hubs, with rental yields above 4.5%.

- Commercial Expansion: New business parks are boosting residential demand.

Future Outlook (2025-26)

Indirapuram & Vaishali will see the highest price appreciation in the next 2-3 years.

Developers are focusing on affordable housing, keeping the market accessible.

RRTS completion will increase demand along the transit corridor.

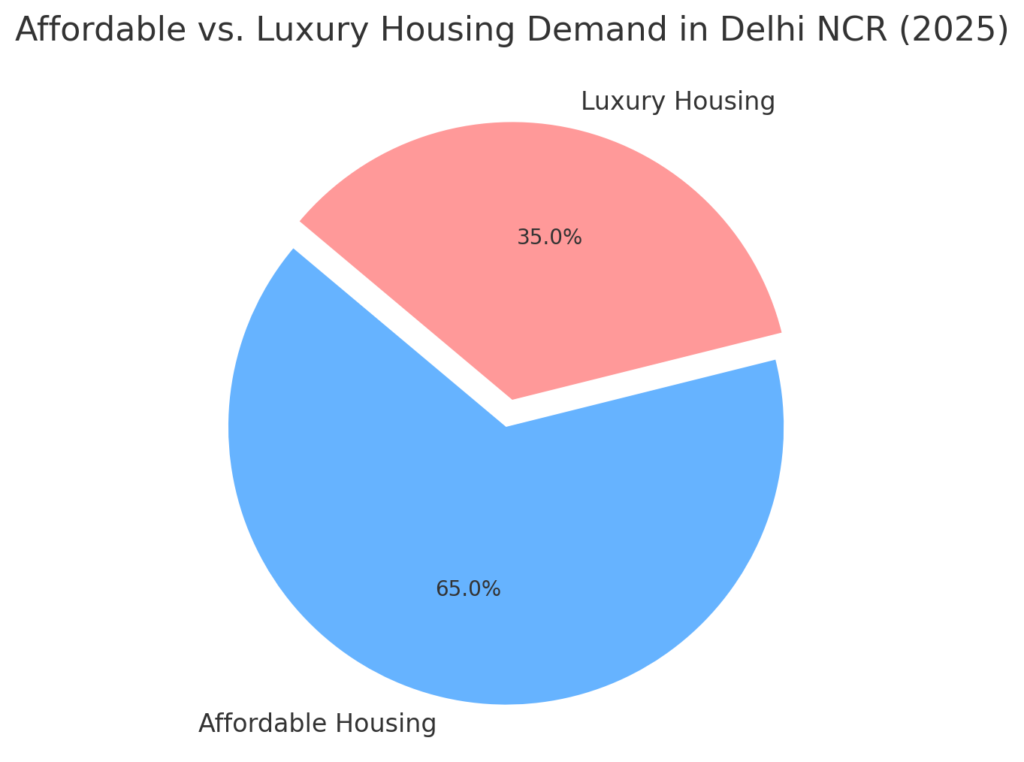

Demand & Supply Analysis in Delhi NCR Real Estate

The real estate market in Delhi NCR experiences diverse demand across various property segments. With rapid urbanization, infrastructure growth, and economic shifts, understanding the demand-supply equation is crucial for buyers and investors.

Affordable Housing: Growing Demand Under PMAY

High Demand in Budget-Friendly Housing

The affordable housing segment (properties priced under ₹50L) has seen significant demand, especially in areas with good connectivity and job hubs. The Pradhan Mantri Awas Yojana (PMAY) has played a crucial role in increasing affordability through subsidies and easy financing options for first-time buyers.

Top 4 Areas for Affordable Housing in Delhi NCR (2025)

- Faridabad: Neharpar (Greater Faridabad) is emerging due to metro expansion.

- Ghaziabad: Raj Nagar Extension offers budget-friendly apartments with good rental yields.

- Noida Extension & Greater Noida: Rapidly growing with new township projects; Metro connectivity has boosted demand.

- Dwarka Expressway: Upcoming connectivity to Delhi and Gurgaon has made it a preferred choice for affordable housing.

Supply vs. Demand Gap

Despite high demand, affordable housing supply remains limited due to rising construction costs and land acquisition issues. Developers are focusing on mid-range and premium projects, leading to a shortage of budget housing units.

Luxury Housing: Surge in High-End Property Investments

Increased Demand for Premium Housing

The luxury housing market (properties above ₹2CR) has witnessed strong demand from high-net-worth individuals (HNI) and non-resident Indians (NRIs), especially post-pandemic. There is a growing demand for ultra-luxury penthouses, villas, and smart homes featuring premium amenities.

Top Luxury Housing Locations in Delhi NCR

- Gurgaon: Golf Course Road, MG Road, and DLF Phases 1 to 5 are hotspots for luxury apartments and villas.

- Noida: Sector 150 and Noida Expressway are witnessing high-end residential developments with smart home features.

- South Delhi: Vasant Vihar, Greater Kailash, and Jor Bagh remain premium investment choices.

- Dwarka Expressway: Fast-growing with premium high-rise societies.

Supply Trends

Leading developers like DLF, M3M, Godrej, ATS, and Tata Housing are launching ultra-luxury projects to cater to high-net-worth individuals. Luxury property supply is increasing, but sales are influenced by factors such as location, brand reputation, and potential resale value.

Commercial Real Estate: IT Hubs, Co-Working Spaces, and Retail Growth

Booming Demand in Office Spaces & Co-working

The rise of startups, IT companies, and hybrid work models has drastically increased demand for co-working and managed office spaces. Top developers like WeWork, Awfis, Smartworks, and Cowrks are expanding their footprint across Gurgaon, Noida, and Delhi.

Key Commercial Hubs in Delhi NCR

- Gurgaon: Cyber City, Udyog Vihar, Golf Course Extension, and Sohna Road are the top choices for IT parks and commercial hubs.

- Noida: Sector 62, Noida Expressway, and Greater Noida are witnessing high demand for office spaces.

- Delhi: Connaught Place, Saket District Center, and Aerocity remain premium commercial locations.

Retail & Shopping Spaces on the Rise

Malls, high-street retail, and mixed-use developments are witnessing strong growth, especially in Gurgaon and Noida. Luxury retail spaces in DLF Emporio (Delhi), Ambience Mall (Gurgaon), and DLF Mall of India (Noida) are attracting international brands.

Supply Trends

Developers are launching Grade A office spaces with sustainable and tech-enabled workplaces. The commercial sector remains highly competitive, with new entrants offering flexible lease models and customized workspaces.

3. Infrastructure Impact on Real Estate

- Jewar Airport: Expected to boost Noida and Greater Noida property values by 20-30%.

- Delhi-Mumbai Expressway: Significant price hikes in Gurgaon and surrounding areas.

- Rapid Metro & RRTS Expansion: Improved connectivity for commuters in Delhi NCR.

Best Areas for Investment in Delhi NCR (2025)

1. Gurgaon

- Best for: Luxury apartments, IT parks, commercial spaces.

- Hotspots: Golf Course Road, Sohna Road, New Gurgaon, Dwarka Expressway.

- Top Builders: DLF, M3M, Godrej, Emaar, Tata Housing.

2. Noida & Greater Noida

- Best for: Affordable and mid-range apartments, IT hubs.

- Hotspots: Sector 150, Sector 137, Pari Chowk, Noida Extension.

- Top Builders: ATS, Godrej, Ace, Supertech, Gaursons.

3. Delhi

- Best for: Independent houses, resale properties, commercial spaces.

- Hotspots: South Delhi (GK, Vasant Vihar, Saket), Central Delhi (Connaught Place, Karol Bagh).

- Top Builders: DLF, TDI, Parsvnath.

4. Faridabad & Ghaziabad

- Best for: Budget apartments, rental investments.

- Hotspots: NHPC Chowk, Neharpar (Faridabad); Indirapuram, Raj Nagar Ext. (Ghaziabad).

- Top Builders: Omaxe, BPTP, Mahagun, Gaursons.

Upcoming Real Estate Projects in Delhi NCR (2025)

1. Residential Projects

- DLF One Midtown (Delhi) – Luxury high-rise living.

- Godrej Woods (Noida) – Forest-themed residences.

- M3M Capital (Gurgaon) – Premium apartments on Dwarka Expressway.

2. Commercial & IT Parks

- World Trade Center (Noida) – Commercial hub for global businesses.

- Cyber City Phase 2 (Gurgaon) – Expansion of India’s top IT hub.

3. Affordable Housing Projects

- PMAY Affordable Housing (Various locations in NCR).

- TATA Housing La Vida (Gurgaon) – Budget-friendly apartments.

Government Policies & Their Impact

How RERA, Stamp Duty Cuts & Smart Cities Are Reshaping Delhi NCR Real Estate (2025 Update)

The real estate sector in Delhi NCR is heavily influenced by government policies and regulatory frameworks. Reforms such as RERA, stamp duty reductions, and urban development initiatives like Smart City projects have played a crucial role in shaping market trends. These policies impact property prices, buyer confidence, investment trends, and overall market stability. Below is a deep dive into key government policies affecting the region’s real estate landscape.

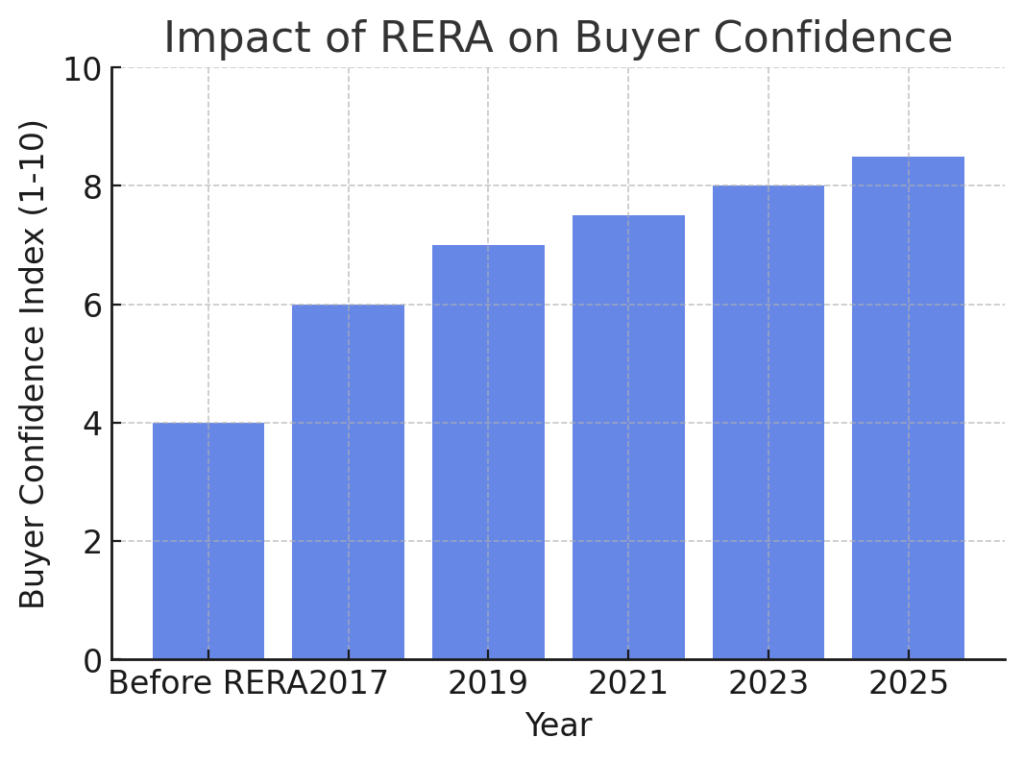

1. RERA (Real Estate Regulation and Development Act) & Its Impact

What is RERA?

The Real Estate (Regulation and Development) Act, 2016 (RERA) was introduced to promote transparency and accountability in the real estate sector. It aims to regulate builders, protect homebuyers from fraud, and ensure timely project completion.

Key Provisions of RERA:

Mandatory Registration – All new and ongoing real estate projects (above a certain size) must be registered with RERA.

Escrow Account for Developers – Builders must deposit 70% of funds received from buyers into an escrow account to prevent fund diversion.

Penalties for Delays – Developers must compensate buyers for project delays.

Standardized Sales Agreements – Reduces unfair terms imposed on homebuyers.

Consumer Dispute Resolution – Establishes RERA authorities and Appellate Tribunals to address buyer complaints.

How RERA Has Changed Delhi NCR’s Real Estate Market:

- Increased Buyer Confidence: With greater transparency, homebuyers are more willing to invest in under-construction properties.

- Higher Accountability for Builders: Developers now focus on timely project completion and quality construction to avoid penalties.

- Reduction in Fraudulent Practices: RERA has significantly reduced cases of project misrepresentation and false promises.

- Growth in Ready-to-Move Properties: Buyers now prefer ready-to-move-in homes over under-construction properties due to past issues with project delays.

Top RERA-Approved Real Estate Projects in Delhi NCR (2025)

📍 Gurgaon – DLF The Camellias, M3M Golf Estate, Godrej Habitat

📍 Noida – ATS Knightsbridge, Tata Eureka Park, Mahagun Medalleo

📍 Delhi – Central Delhi Redevelopment Projects, Anant Raj Estates

📍 Faridabad – Puri Aanandvilas, Omaxe World Street

📍 Ghaziabad – Gaurs Siddhartham, ATS Advantage

For a complete list of top RERA-approved projects, check out our detailed guide on Upcoming RERA-Approved Projects in Delhi NCR.

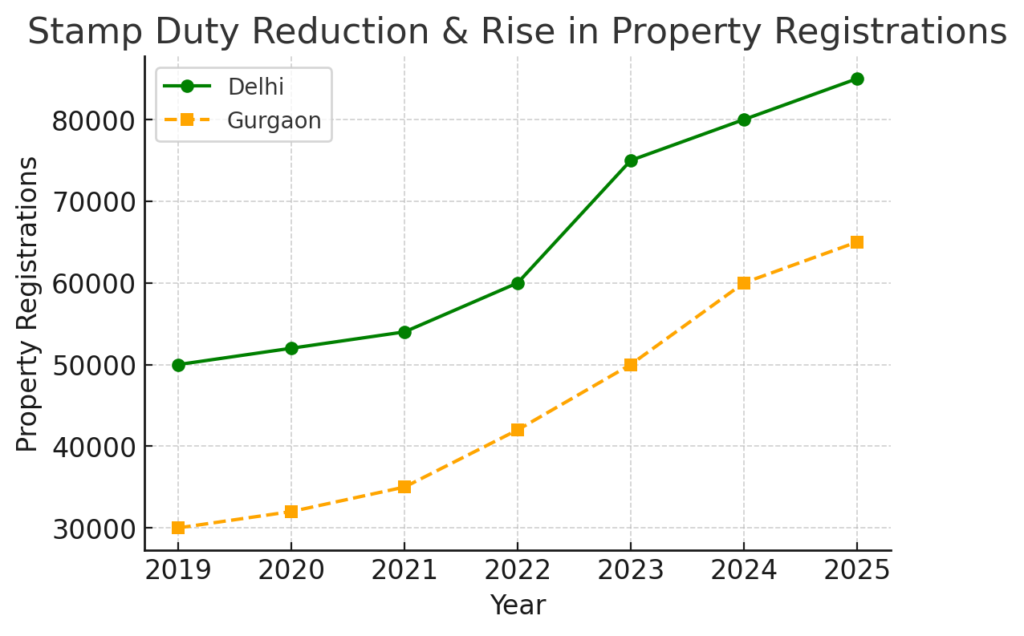

2. Stamp Duty Reforms & Their Influence on Property Transactions

Stamp duty is a crucial cost component in real estate transactions. Changes in stamp duty rates can significantly impact buyer sentiment, affordability, and transaction volumes.

Recent Stamp Duty Changes in Delhi NCR

| Region | Previous Rate | Revised Rate (2024-25) | Impact |

|---|---|---|---|

| Delhi | 6% (men), 4% (women) | 5% (men), 3% (women) | Increased property registrations, more women homebuyers |

| Haryana (Gurgaon, Faridabad, etc.) | 7% | 6% | Boosted residential transactions |

| Uttar Pradesh (Noida, Ghaziabad, Greater Noida) | 7% | No recent change | Market remains stable |

Impact of Lower Stamp Duty Rates

Higher Property Transactions – Delhi and Gurgaon saw a 15-20% increase in property registrations post the reduction.

Rise in Women Homebuyers – The lower stamp duty for women has encouraged more female ownership.

Boost in Mid-Segment Housing – Buyers looking at homes under ₹1.5 Cr have benefited the most from lower transaction costs.

Developers Offer Additional Incentives – To leverage the lower stamp duty, some developers provide extra discounts or waive other charges.

Want to calculate stamp duty on your new home? Use our Delhi NCR Stamp Duty Calculator.”

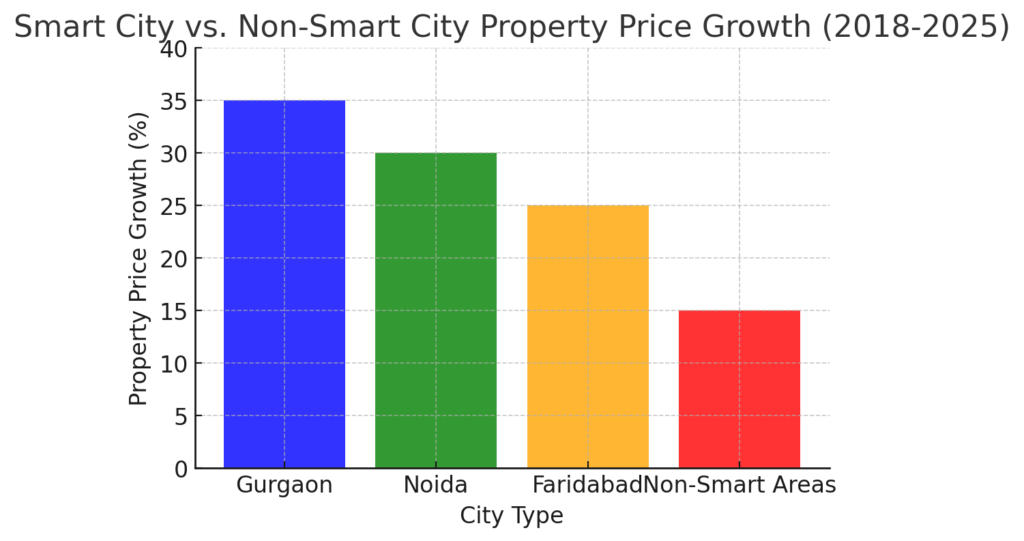

3. Smart City Initiatives & Infrastructure Growth

Delhi NCR has been a major beneficiary of India’s Smart City Mission, with cities like Gurgaon, Faridabad, and Noida receiving increased government funding for infrastructure modernization.

Key Smart City Developments in Delhi NCR (2025)

📍 Gurgaon:

- Expansion of Gurgaon Metro to Old Gurgaon & Dwarka Expressway

- AI-driven traffic management to reduce congestion

- 100% smart LED street lighting & surveillance systems

📍 Noida & Greater Noida:

- Noida International Airport (Jewar) – A game-changer for commercial & residential demand

- Introduction of Public Bike Sharing (PBS) Systems

- Expansion of Metro Aqua Line to Greater Noida West

📍 Faridabad:

- Smart Road Infrastructure (sensor-based parking, digital signage)

- Integrated Transport System linking metro, buses & e-rickshaws

- Growth of Faridabad Industrial Model Town (IMT) for employment generation

Impact of Smart City Projects on Real Estate

Higher Property Valuation: Prices in Smart City zones are rising faster than in non-smart regions.

Better Rental Demand: Improved infrastructure attracts working professionals, boosting rental income potential.

Increased Commercial Growth: Companies prefer office spaces in well-connected smart cities, increasing demand for Grade A commercial properties.

Investment Hotspots Benefiting from Smart City Initiatives

Gurgaon: Dwarka Expressway, Sector 113, New Gurgaon

Noida: Sector 150, Noida Extension, Sector 143

Faridabad: Neharpar (Greater Faridabad), Sector 88, Sector 89

Want to invest in a future-ready city? Explore our guide on Best Smart City Investment Locations in Delhi NCR.”

Home Loan & Financing Trends in 2025

The Delhi NCR real estate market is shaped not only by property prices and government policies but also by evolving home loan trends. In 2025, factors such as interest rate stabilization, new loan schemes, and strategic financing options are playing a crucial role in home-buying decisions.

For potential buyers, understanding these financing trends is key to securing the best mortgage deals and making informed investments.

1. Interest Rate Trends in 2025

Interest rates directly impact home loan affordability, influencing EMI amounts and total repayment costs. In 2025, experts predict that home loan interest rates will stabilize between 7.5% and 8.5%, driven by economic factors like RBI policies, inflation control, and global financial conditions.

Key Factors Influencing Interest Rates

- RBI Repo Rate Movements – Any changes in the RBI’s repo rate will directly affect lending rates. A stable repo rate indicates predictable home loan rates.

- Inflation Trends – With inflation expected to remain controlled, significant interest rate hikes are unlikely.

- Banking Competition – Public and private banks continue to compete, offering lower interest rates, balance transfer benefits, and flexible repayment options to attract borrowers.

Current Interest Rate Comparison (2025)

| Lender | Floating Rate (%) | Fixed Rate (%) |

|---|---|---|

| SBI Home Loan | 8.25% | 8.50% |

| HDFC Home Loan | 8.20% | 8.45% |

| ICICI Bank | 8.30% | 8.60% |

| PNB Housing Finance | 8.50% | 8.75% |

| LIC Housing Finance | 8.40% | 8.65% |

Pro Tip: Compare loan tenure and EMI options before finalizing a lender.

Use our Home Loan EMI Calculator to estimate monthly payments.

2. Top Home Loan Schemes for 2025

Banks and financial institutions offer a range of home loan schemes tailored to different buyer needs, from first-time buyers to high-income professionals.

Best Home Loan Schemes in 2025

Pradhan Mantri Awas Yojana (PMAY) – CLSS

- Interest subsidy up to ₹2.67 lakh for first-time homebuyers.

- Focuses on affordable housing in urban and semi-urban areas.

SBI MaxGain Home Loan

- Linked to an overdraft facility, allowing borrowers to save on interest.

- Ideal for those looking for flexible loan repayment options.

HDFC Home Loan for Salaried & Self-Employed

- Low processing fees and fast approval process.

- Special offers available for women borrowers and first-time buyers.

ICICI Bank Step-Up Home Loan

- Lower initial EMIs that gradually increase over time.

- Perfect for young professionals with salary growth potential.

Bank of Baroda Home Loan Advantage

- Competitive interest rates with zero prepayment charges for floating-rate loans.

- Balance transfer facility available for better loan management.

Pro Tip: Consider loan prepayment options to reduce long-term interest payments.

Confused about which loan suits you? Read our Best Home Loan Schemes in India for 2025 guide.

3. Smart Home Loan Tips for Buyers

Compare Interest Rates & Loan Offers

- Check both fixed and floating rates to choose the most cost-effective loan.

- Look for seasonal offers from banks that reduce processing fees.

Choose the Right Loan Tenure

- Shorter tenure (10-15 years): Higher EMIs but lower total interest.

- Longer tenure (20-30 years): Lower EMIs but higher overall cost.

Verify the Lender’s Credibility

- Choose reputed banks and NBFCs with transparent terms.

- Check customer reviews and loan processing time before applying.

Maintain a Good Credit Score (750+ for Best Rates)

- A CIBIL score of 750+ qualifies you for lower interest rates and better terms.

- Avoid late payments on credit cards and existing loans.

Factor in Additional Costs

- Consider processing fees, prepayment charges, and stamp duty before finalizing a loan.

- Look out for festive season discounts where banks waive processing fees.

Pro Tip: Negotiate with banks for better loan terms, especially if you have a high credit score.

Planning your dream home? Read our Expert Tips on Getting the Best Home Loan Deal.

Further Reading

For a deeper understanding, check out related articles:

- Top Areas to Buy a Home in Gurgaon (2025)

- Upcoming Affordable Housing Projects in Delhi NCR (Under ₹50L)

- Luxury Apartments in Noida – Best Societies & Builders

- Is It Better to Rent or Buy Property in Delhi NCR? (2025 Analysis)

- Commercial Property Investment Guide – Best Sectors in Gurgaon & Noida

Key Takeaways

✅ Delhi NCR’s real estate market is diverse, with opportunities across luxury, affordable, and commercial segments.

✅ Upcoming infrastructure projects like Jewar Airport will reshape investment hotspots.

✅ Government policies and home loan trends play a major role in property demand.

✅ Choosing the right location based on investment goals is crucial for high returns.

Frequently Asked Questions (FAQs)

Q1: Is 2025 a good year to invest in real estate in Delhi NCR?

Yes, 2025 is expected to be a strong year for real estate investment in Delhi NCR due to infrastructure growth, rising property demand, and favorable home loan interest rates. Areas with metro expansions and Smart City initiatives are likely to see the highest appreciation.

Q2: How will home loan interest rates affect property buyers in 2025?

Home loan interest rates are projected to stabilize between 7.5% and 8.5%. This creates a favorable borrowing environment, allowing homebuyers to lock in lower rates and reduce long-term costs. Comparing fixed and floating rate options is essential for better financial planning.

Q3: What are the best home loan schemes available in 2025?

Some of the best home loan schemes include Pradhan Mantri Awas Yojana (PMAY) for first-time buyers, SBI MaxGain for flexible repayment, and ICICI Step-Up Home Loan for young professionals. Each scheme has different benefits, making it important to choose based on your financial profile.

Q4: What is the impact of RERA on homebuyers in Delhi NCR?

RERA has significantly increased transparency and accountability in the real estate sector, ensuring that projects are completed on time and buyers receive what was promised. This has boosted buyer confidence and led to more secure real estate transactions.

Q5: Which areas in Delhi NCR are expected to see the highest property price appreciation?

Locations such as Dwarka Expressway, Noida Extension, and sectors along the upcoming metro corridors in Gurgaon and Faridabad are projected to experience high property price appreciation due to improved infrastructure and growing demand.

Q6: How does stamp duty reduction affect real estate investment?

Lower stamp duty reduces the overall cost of property transactions, making it more affordable for homebuyers and increasing property registrations. This benefits both investors and first-time buyers looking to enter the market.

Q7: What is the difference between Smart City and non-Smart City property growth?

Smart Cities generally experience higher property price appreciation due to better infrastructure, digital integration, and enhanced urban planning. Buyers prefer Smart City locations for improved quality of life and long-term investment security.

Q8: What are the key factors to consider when applying for a home loan in 2025?

Important factors include your credit score (750+ for better interest rates), EMI affordability, loan tenure, lender credibility, and additional charges like processing fees and prepayment penalties. Comparing multiple lenders can help secure the best deal.

Q9: How can buyers maximize their return on investment in Delhi NCR real estate?

To maximize ROI, buyers should invest in under-construction projects for lower prices, choose locations with upcoming infrastructure developments, and consider rental yield potential. Commercial properties and high-demand residential areas also offer strong investment opportunities.

Q10: What are the risks of buying property in Delhi NCR, and how can they be avoided?

Common risks include project delays, legal disputes, and hidden costs. To avoid these, buyers should check RERA registrations, verify builder credibility, review all legal documents, and work with reputed financial institutions for home loan approvals.

Final Thoughts

The Delhi NCR real estate market in 2025 offers exciting opportunities for investors, homebuyers, and businesses. With the right research, location choices, and financial planning, you can make informed investment decisions and maximize returns.

For more insights, latest property news, and expert recommendations, stay tuned to NCR Guide!