As 2025 approaches, homeownership remains a key aspiration for many individuals across India. With a broad range of home loan schemes available from various banks and financial institutions, prospective homeowners have a wide variety of options to choose from. This comprehensive guide explores the best home loan schemes for 2025, helping you make an informed decision based on interest rates, eligibility criteria, and loan tenures.

Whether you’re a first-time homebuyer or looking to refinance your existing loan, understanding these home loan schemes is essential to secure the best deal. Let’s dive into the top home loan options in India for 2025.

Top Home Loan Schemes in India for 2025

1. State Bank of India (SBI) – Home Loan Scheme

The State Bank of India (SBI) offers one of the most competitive home loan schemes in India, making it a preferred choice for many homebuyers.

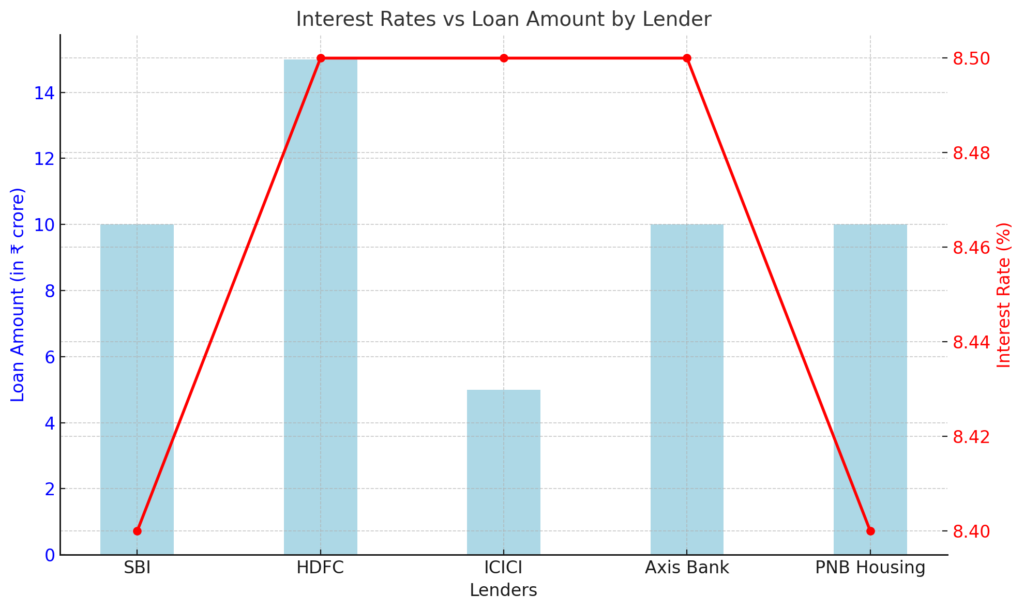

- Loan Amount: Up to ₹10 crore (for high-value homes)

- Interest Rate: Starting from 8.40% p.a.

- Processing Fee: 0.35% of the loan amount (subject to a minimum of ₹10,000)

- Tenure: Up to 30 years

- Eligibility: Salaried individuals, self-employed professionals, business owners.

Benefits:

- Competitive Interest Rates: SBI offers some of the most affordable rates in the market.

- Flexible Loan Tenure: With tenures of up to 30 years, SBI allows borrowers to manage EMIs comfortably.

- Online Application Process: The SBI home loan application process is seamless and can be done online, saving time and effort.

Things to Consider:

- Processing Fees: Processing fees may vary depending on the loan amount.

- Prepayment/Foreclosure Charges: Prepayment and foreclosure charges may apply for early repayment.

2. HDFC Ltd – Home Loan Scheme

HDFC Ltd is one of India’s leading housing finance companies, known for offering home loans with attractive features and flexible terms.

- Loan Amount: Up to ₹15 crore (for luxury homes)

- Interest Rate: Starting from 8.50% p.a.

- Processing Fee: 0.50% of the loan amount (minimum ₹3,000)

- Tenure: Up to 30 years

- Eligibility: Indian residents and NRIs

Benefits:

- Quick Disbursal: HDFC is known for fast approval and disbursal.

- Top-Up Loans: Affordable top-up loans are available for existing customers.

- Financial Advisory: Get expert advice on managing your finances and loans.

Things to Consider:

- Processing fees can be high depending on the loan amount.

- Documentation requirements may be more extensive compared to other lenders.

3. ICICI Bank – Home Loan Scheme

ICICI Bank provides flexible home loan schemes with low interest rates and convenient repayment options.

- Loan Amount: Up to ₹5 crore

- Interest Rate: Starting from 8.50% p.a.

- Processing Fee: ₹3,000 to ₹10,000

- Tenure: Up to 30 years

- Eligibility: Salaried employees, self-employed professionals, business owners.

Benefits:

- Balance Transfer Option: Transfer your home loan from other banks at a lower interest rate.

- Flexible EMI Options: ICICI offers various EMI options that cater to your financial needs.

- Quick Loan Processing: The loan processing time is generally faster compared to other lenders.

Things to Consider:

- Processing fees may vary, so it’s important to confirm the charges beforehand.

- The loan eligibility is dependent on your credit score and income level.

4. Axis Bank – Home Loan Scheme

Axis Bank offers a wide range of home loan products designed for salaried individuals and self-employed professionals.

- Loan Amount: Up to ₹10 crore

- Interest Rate: Starting from 8.50% p.a.

- Processing Fee: 1% of the loan amount (maximum ₹10,000)

- Tenure: Up to 30 years

- Eligibility: Salaried employees, self-employed professionals, NRIs

Benefits:

- Special Offers for Women: Axis Bank offers special home loan rates for women borrowers.

- Balance Transfer Facility: Transfer your existing home loan to Axis Bank with lower interest rates.

- Convenient Online Application: Apply online and get quick approval.

Things to Consider:

- Loan tenure can be extended up to 30 years, but longer tenures increase the total interest paid.

- Processing fees apply and can vary.

5. PNB Housing Finance – Home Loan Scheme

PNB Housing Finance is known for providing affordable and transparent home loan options to individuals across India.

- Loan Amount: Up to ₹10 crore

- Interest Rate: Starting from 8.40% p.a.

- Processing Fee: 0.50% of the loan amount

- Tenure: Up to 30 years

- Eligibility: Salaried individuals, self-employed professionals, NRIs

Benefits:

- Competitive Interest Rates: PNB offers some of the lowest rates in the market.

- Transparent Fees: No hidden charges; the fee structure is clear.

- Pre-EMI Option: During the construction phase, you can opt to pay only the interest on the loan.

Things to Consider:

- Processing time may be slightly longer compared to some other lenders.

- Loan eligibility and the amount sanctioned depend on the applicant’s income and credit score.

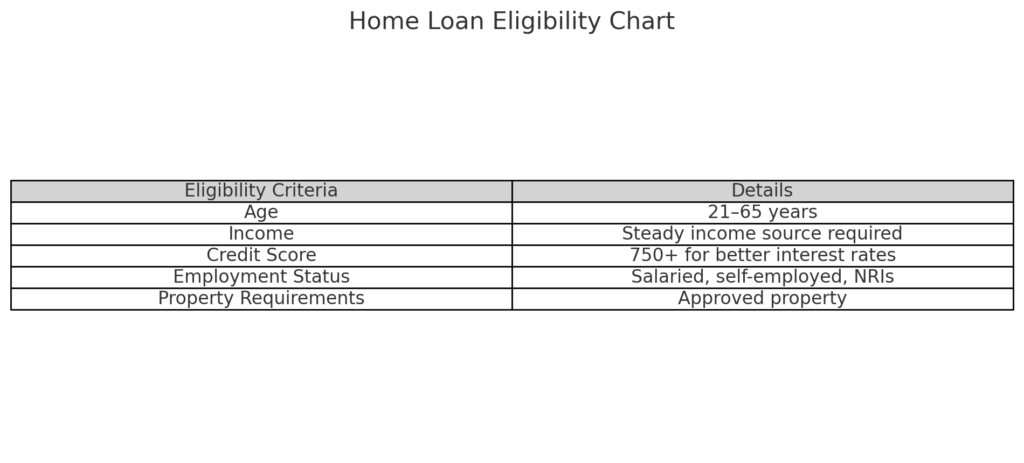

Home Loan Eligibility Criteria

Eligibility for home loans in India depends on various factors, including your age, income, credit score, and employment status. Here’s a quick overview of the general eligibility criteria:

| Criteria | Details |

|---|---|

| Age | 21 to 65 years (for salaried individuals) |

| Income | Regular, steady income from a recognized source |

| Credit Score | Preferably 750 or above (higher scores secure better rates) |

| Employment Status | Salaried, self-employed, business owners, or NRIs |

| Property Value | Must meet the lender’s valuation standards |

Factors to Consider Before Choosing a Home Loan

1. Interest Rates

The interest rate directly impacts your monthly EMI and the total cost of the loan. Look for lowest interest rates and understand whether the rate is fixed or floating.

2. Processing Fees

Always compare the processing fees charged by different lenders. These fees typically range from 0.5% to 1% of the loan amount.

3. Loan Tenure

A longer tenure reduces your monthly EMI but results in higher overall interest payments. Choose a tenure that balances affordability and total cost.

4. Prepayment and Foreclosure Charges

Check the lender’s policy regarding prepayment and foreclosure. Some lenders charge penalties for early repayment, while others offer flexibility.

5. Loan Amount

Ensure the lender offers an amount that is adequate to cover your property’s price, including registration and stamp duty costs.

Home Loan Comparison Table

| Lender | Interest Rate (Starting) | Loan Amount | Processing Fee | Tenure (Max.) | Eligibility |

|---|---|---|---|---|---|

| SBI | 8.40% p.a. | Up to ₹10 crore | 0.35% (min ₹10,000) | 30 years | Salaried, self-employed, business owners |

| HDFC | 8.50% p.a. | Up to ₹15 crore | 0.50% (min ₹3,000) | 30 years | Indian residents, NRIs |

| ICICI | 8.50% p.a. | Up to ₹5 crore | ₹3,000 – ₹10,000 | 30 years | Salaried, self-employed, NRIs |

| Axis Bank | 8.50% p.a. | Up to ₹10 crore | 1% of loan amount | 30 years | Salaried, self-employed, NRIs |

| PNB Housing | 8.40% p.a. | Up to ₹10 crore | 0.50% | 30 years | Salaried, self-employed, NRIs |

Frequently Asked Questions (FAQs)

1. What is the eligibility for a home loan in India?

Answer: To qualify for a home loan in India, applicants typically need to be between 21 to 65 years old, have a steady source of income, a credit score of 750 or above, and meet other lender-specific criteria. Eligibility also depends on employment status, income, and property value.

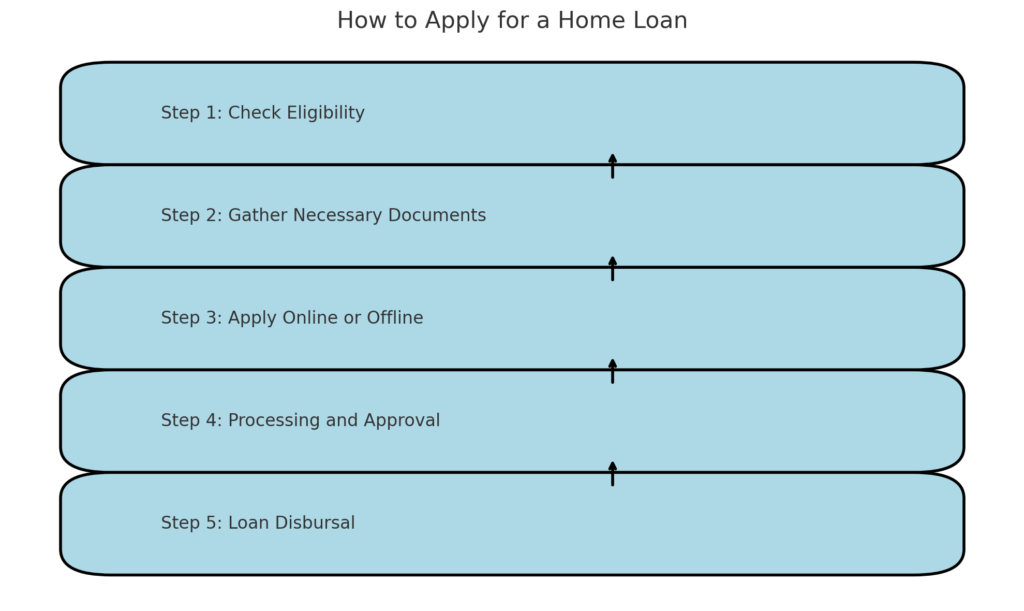

2. What documents are required for a home loan in India?

Answer: Common documents required for a home loan application include:

- Identity proof (Aadhaar card, passport, voter ID)

- Address proof (utility bills, passport, etc.)

- Income proof (salary slips, tax returns, bank statements)

- Property documents (sale agreement, property title)

- Credit report (from a credit bureau)

3. Can I get a home loan if I have a low credit score?

Answer: While a high credit score (750+) improves your chances of getting a home loan with favorable terms, it’s still possible to get a loan with a lower credit score. However, you may face higher interest rates or a lower loan amount. It’s advisable to improve your credit score before applying for a loan.

4. What is the difference between a fixed and floating interest rate on a home loan?

Answer: A fixed interest rate remains the same throughout the loan tenure, offering stable EMIs. A floating interest rate varies with market conditions, which means your EMIs could increase or decrease based on changes in interest rates.

5. How much home loan can I get based on my salary?

Answer: The home loan amount you can get is typically based on your monthly income and credit score. Lenders usually offer 60% to 80% of the property value as a loan, and the EMI should not exceed 40% to 50% of your monthly income.

Conclusion: Best Home Loan Schemes for 2025

Choosing the right home loan is crucial to making your dream of homeownership a reality. In 2025, the State Bank of India (SBI), HDFC Ltd, ICICI Bank, Axis Bank, and PNB Housing Finance offer some of the best home loan schemes, each catering to different needs and financial situations. Whether you’re looking for low-interest rates, flexible tenures, or competitive processing fees, these schemes are designed to meet a variety of requirements.

Before applying for a home loan, make sure to compare interest rates, check eligibility based on your income and credit score, and understand the processing fees, prepayment charges, and other terms to make an informed decision.

If you are unsure about which scheme suits your needs, consider speaking with a financial advisor or loan expert who can help guide you through the process and ensure that you choose the most beneficial option for your home loan.

For personalized advice or to apply for one of the best home loan schemes for 2025, feel free to contact us or explore the loan options mentioned above.