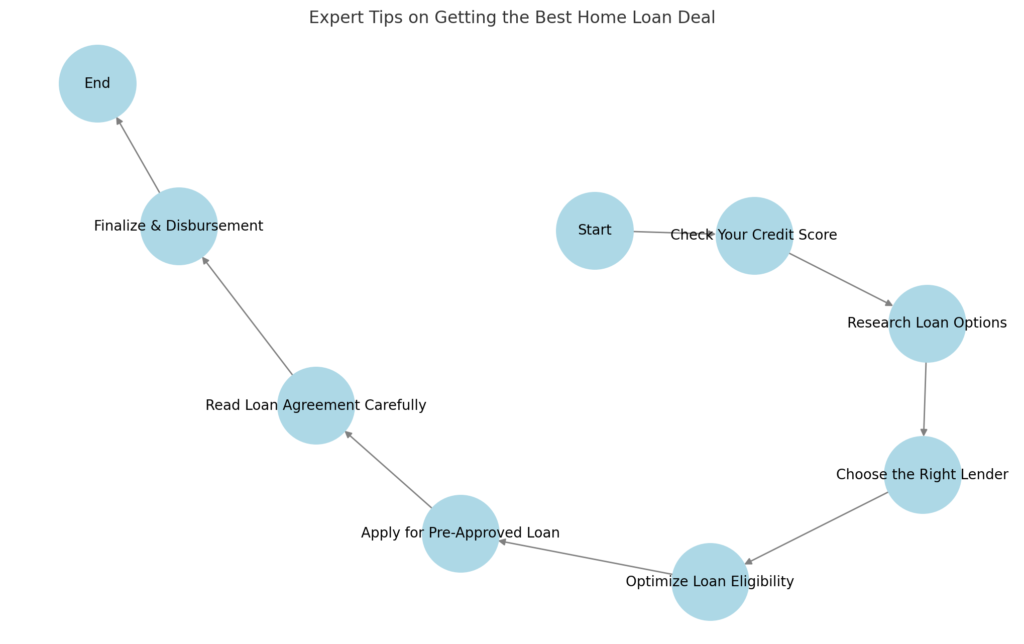

Buying a home is one of the most significant financial decisions of your life, and choosing the right home loan can make a world of difference in how smoothly the process goes. With numerous home loan providers offering a variety of schemes, it can be overwhelming to choose the best one. But with a little bit of knowledge and a careful approach, you can secure the best home loan deal for your needs.

This article offers expert tips to help you find the best home loan deal for 2025, from understanding the factors that affect your loan to negotiating with lenders for better terms.

1. Start by Checking Your Credit Score

Your credit score plays a crucial role in determining the interest rate on your home loan. Lenders use your credit score to assess your creditworthiness and decide how risky it is to lend to you. A higher score means you are more likely to get a loan at favorable terms.

Why it matters:

- Higher credit scores (750 or above) generally qualify for lower interest rates, reducing the overall cost of your loan.

- Lower credit scores may lead to higher interest rates, higher EMIs, and even rejection of your loan application.

Tip:

Before applying for a loan, check your credit score through online tools or credit bureaus (such as CIBIL, Experian, or Equifax). If your score is lower than 750, consider improving it by clearing any outstanding debts or correcting any errors in your credit report.

2. Compare Multiple Lenders

One of the biggest mistakes homebuyers make is settling for the first home loan offer they receive. Each lender has different terms, interest rates, processing fees, and eligibility criteria. By comparing multiple lenders, you can ensure you’re getting the best deal.

Things to compare:

- Interest Rates: A difference of even 0.25% in interest rates can lead to a significant difference in monthly EMIs over the life of the loan.

- Processing Fees: Some lenders charge hefty processing fees. Always check this upfront to avoid any surprises.

- Prepayment and Foreclosure Charges: If you plan to repay the loan early, ensure you understand the penalties, if any.

- Loan Tenure: A longer tenure results in smaller EMIs, but a larger total interest payout. Choose a tenure that balances your monthly budget with long-term financial goals.

Tip:

Use online comparison tools to quickly compare interest rates, processing fees, and other charges across different lenders.

3. Understand the Types of Interest Rates

In India, home loans typically come with either fixed or floating interest rates, and understanding the difference is key to getting the best deal.

Fixed Interest Rate:

- Remains the same throughout the loan tenure.

- Helps with predictable EMIs, but may be slightly higher than floating rates.

- Suitable for those who want stability in their monthly payments.

Floating Interest Rate:

- Changes with market conditions, typically linked to an external benchmark like the Repo Rate or MCLR (Marginal Cost of Funds based Lending Rate).

- Floating rates are often lower than fixed rates, but they can increase if interest rates go up.

- Suitable for borrowers who are comfortable with fluctuations in their EMIs.

Tip:

If you are opting for a floating rate, check if your lender offers a cap on the rate, ensuring your interest doesn’t rise beyond a certain level.

4. Calculate Your Loan Eligibility

Before applying for a home loan, use eligibility calculators provided by lenders or financial websites. These calculators determine how much loan you can afford based on your monthly income, existing debts, credit score, and age.

Things that affect your eligibility:

- Income: Higher income increases your eligibility for a larger loan amount.

- Debt-to-Income Ratio (DTI): Lenders look at your existing financial obligations (other loans, credit card payments, etc.) to calculate your DTI ratio. A lower ratio increases your chances of approval.

- Age: Most lenders prefer borrowers between 21 and 65 years of age, as they expect the loan to be repaid before retirement.

Tip:

Be honest when entering your income and expenses. If your eligibility is lower than expected, consider adjusting your loan amount or choosing a longer tenure.

5. Don’t Overstretch Your Budget

While it’s tempting to buy the biggest home you can afford, remember that a home loan is a long-term financial commitment. Ensure that your monthly EMI fits comfortably within your budget. A general rule of thumb is to keep your EMI at or below 40%-50% of your monthly income.

Tip:

Calculate the EMI using an online EMI calculator before applying. Consider future expenses such as children’s education, healthcare, and other investments before deciding on the loan amount.

6. Negotiate Terms with Your Lender

Many borrowers don’t realize they can negotiate the terms of their home loan. While the interest rate might not be flexible in all cases, you can still negotiate other factors, such as processing fees, prepayment options, and even the loan amount.

Tip:

Once you’ve compared offers from different lenders, approach your preferred lender with the terms from others. Lenders may be willing to match or beat competitors’ offers to secure your business.

7. Check for Government Schemes and Subsidies

The Indian government offers various schemes, such as the Pradhan Mantri Awas Yojana (PMAY), which provides subsidies on home loans for eligible borrowers. These schemes are especially beneficial for first-time homebuyers and low-income individuals.

Eligibility for PMAY:

- Income Limit: PMAY benefits are available to those with annual household income of up to ₹18 lakh.

- Subsidy: Depending on your income, you can get interest subsidies of up to 6.5% on home loans under PMAY.

Tip:

Check if you qualify for any government schemes before finalizing your loan. The subsidy can significantly reduce your EMI burden.

8. Lock-in the Best Rate Early

Interest rates are not fixed and can fluctuate due to various economic factors. Once you’ve identified the best interest rate, try to lock in that rate for as long as possible to avoid sudden increases.

Tip:

Many lenders offer a rate lock-in option for up to 6 months. If you find a favorable rate, locking it in early can prevent you from paying higher rates if the market rates rise.

9. Keep the Documentation in Order

To avoid delays in loan approval, ensure all the required documents are ready before applying. Typically, these documents include:

- Proof of identity (Aadhaar, Passport, etc.)

- Proof of income (salary slips, bank statements)

- Property documents (sale agreement, title deed)

- Credit report

Tip:

Ensure all documents are up to date and free of errors. Any discrepancies in your paperwork can lead to delays or rejection.

10. Review the Fine Print

Before signing the agreement, thoroughly review the loan agreement to understand all the terms and conditions. Pay attention to:

- Prepayment charges (if applicable)

- Foreclosure charges

- Disbursement process and timing

- Any hidden fees that may arise during the loan tenure.

Tip:

Ask your lender to explain any terms you don’t understand, especially when it comes to fees, charges, or penalties.

Frequently Asked Questions (FAQs)

1. What is the eligibility for a home loan in India?

Answer: To qualify for a home loan in India, applicants typically need to be between 21 to 65 years old, have a steady source of income, a credit score of 750 or above, and meet other lender-specific criteria. Eligibility also depends on employment status, income, and property value.

2. What documents are required for a home loan in India?

Answer: Common documents required for a home loan application include:

- Identity proof (Aadhaar card, passport, voter ID)

- Address proof (utility bills, passport, etc.)

- Income proof (salary slips, tax returns, bank statements)

- Property documents (sale agreement, property title)

- Credit report (from a credit bureau)

3. Can I get a home loan if I have a low credit score?

Answer: While a high credit score (750+) improves your chances of getting a home loan with favorable terms, it’s still possible to get a loan with a lower credit score. However, you may face higher interest rates or a lower loan amount. It’s advisable to improve your credit score before applying for a loan.

4. What is the difference between a fixed and floating interest rate on a home loan?

Answer: A fixed interest rate remains the same throughout the loan tenure, offering stability. A floating interest rate fluctuates based on market conditions, which means your EMIs could change over time.

5. How much home loan can I get based on my salary?

Answer: The home loan amount you can get is typically based on your monthly income and credit score. Lenders usually offer 60% to 80% of the