Introduction

In a major policy shift, the Indian government is steering away from aggressive privatization and focusing instead on revitalizing struggling state-run enterprises. This change in approach reflects a strategic move to modernize public sector undertakings (PSUs), safeguard jobs, and maintain control over key industries.

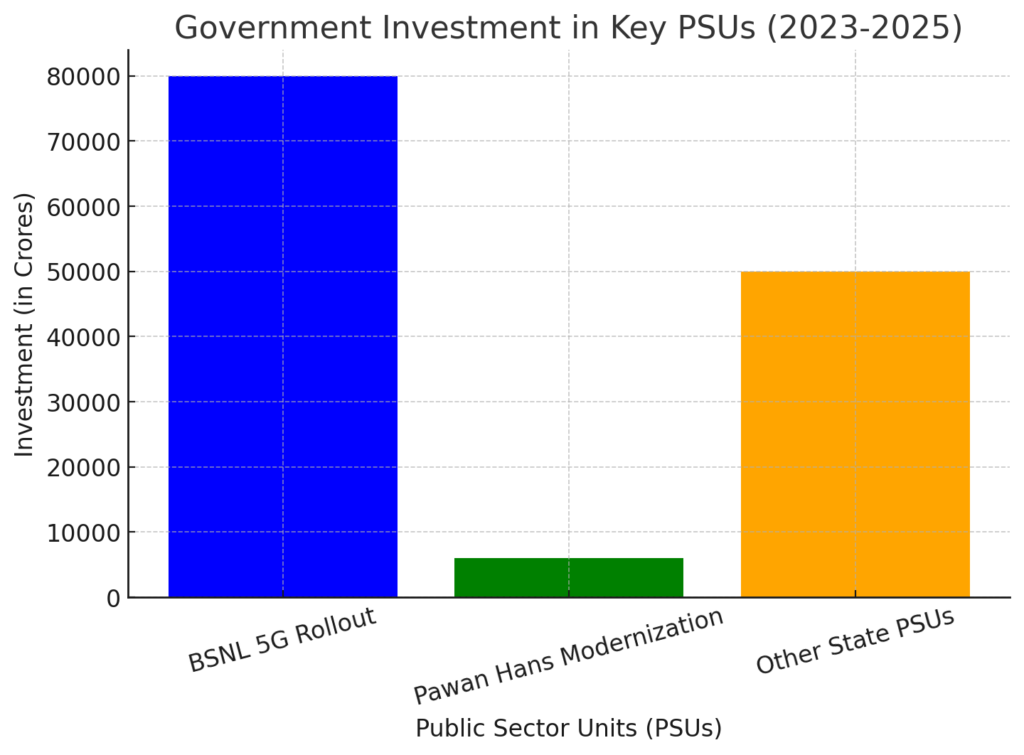

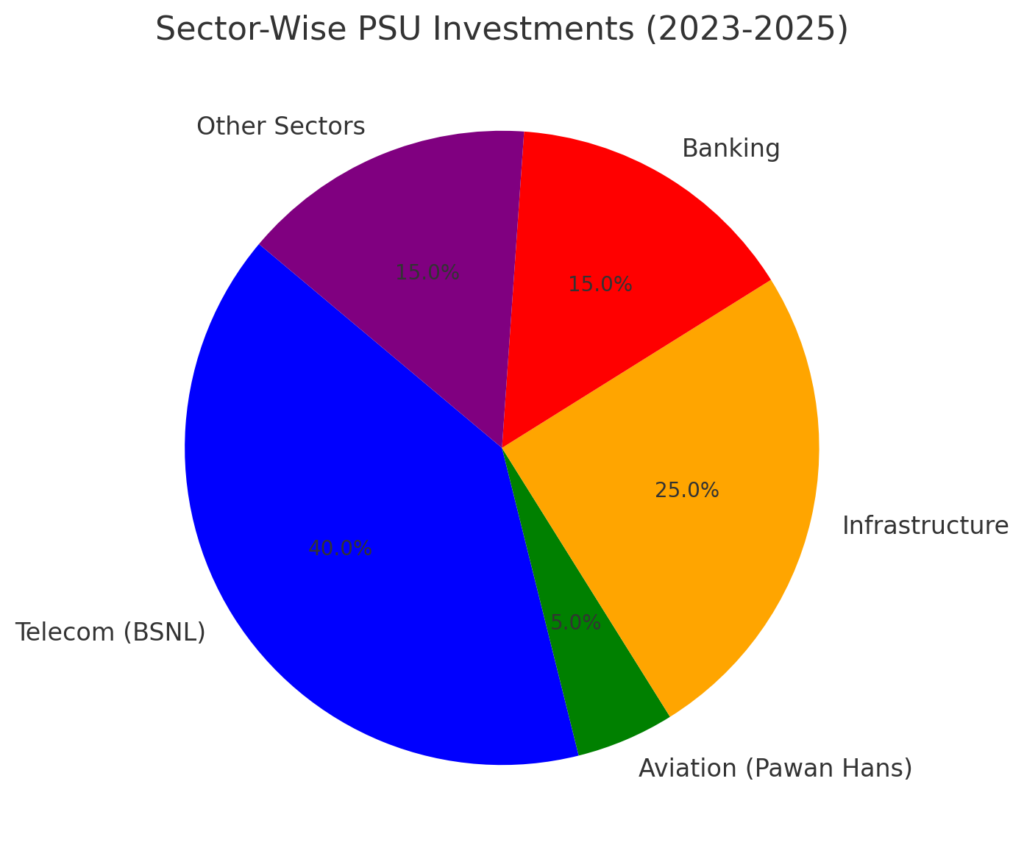

Among the primary beneficiaries of this shift is Pawan Hans, India’s leading helicopter service provider, which is set for a major modernization effort. Other sectors, including telecommunications, steel, and railways, are also expected to receive significant investments aimed at making them competitive and self-sustaining.

Why the Government is Changing Course

The decision to scale back privatization stems from multiple economic and political considerations. One key factor is the need to preserve jobs in labor-intensive industries. Large-scale privatization often leads to workforce reductions, which can create social unrest, particularly in a country where employment security is a major concern.

Another crucial reason is the strategic importance of certain PSUs. Entities like BSNL in telecom, SAIL in manufacturing, and Pawan Hans in aviation play a vital role in India’s economic and infrastructural backbone. Selling off these assets to private firms could result in monopolization risks, reduced service reach in rural areas, and potential national security concerns.

Additionally, privatization efforts have faced market resistance. The sale of some PSUs failed to attract sufficient investor interest due to financial risks and structural inefficiencies, forcing the government to rethink its approach.

Key PSUs Set for Revitalization

1. Pawan Hans: Strengthening Aviation Services

Pawan Hans, India’s primary provider of helicopter services, is set to undergo fleet modernization to improve regional air connectivity, particularly in remote and hilly areas. The company will receive government funding to replace aging aircraft, ensuring safer and more efficient operations.

2. BSNL: Competing in the 5G Era

The government is infusing fresh capital into BSNL to enable a nationwide 4G and 5G rollout. This initiative aims to:

- Strengthen India’s telecom sector by offering state-backed competition to private players.

- Improve connectivity in rural and underdeveloped areas where private operators may not find operations profitable.

- Reduce dependence on foreign telecom infrastructure, aligning with India’s self-reliance goals.

3. SAIL & Other Manufacturing PSUs: Boosting Domestic Production

Public sector steel companies like SAIL are expected to receive investments for technological upgrades. The goal is to make them globally competitive while also supporting India’s infrastructure expansion. By modernizing steel plants, the government hopes to:

- Strengthen Make in India initiatives.

- Reduce dependency on imported raw materials.

- Enhance global export potential.

4. Indian Railways: Efficiency Over Privatization

While privatization of Indian Railways was once a key discussion point, the government is now leaning towards a hybrid approach. Instead of outright privatization, the focus will be on:

- Public-private partnerships (PPPs) to enhance efficiency while keeping control over critical operations.

- Upgrading high-speed rail networks and investing in modern locomotives.

Impact on the Economy and Market

Economic Growth & Industrial Development

The shift from privatization to revitalization will direct substantial capital into infrastructure, manufacturing, and telecom, leading to job creation and economic expansion. Strengthening PSUs can ensure the continuity of essential services, particularly in sectors where profit-driven private enterprises might not prioritize public welfare.

However, some experts warn that continued state control over unprofitable enterprises could strain government finances unless reforms are introduced to improve PSU efficiency.

Investor Sentiment: Mixed Reactions

Market analysts have offered mixed reactions to the policy shift. While some argue that supporting PSUs ensures economic stability, others believe it could slow down much-needed privatization efforts. Investors seeking more aggressive economic liberalization may find this move less favorable.

Job Security and Workforce Implications

For the labor force, this shift brings job security and stability, especially for workers in industries previously threatened by privatization. However, experts caution that financial aid alone will not make PSUs profitable—structural reforms and improved management are equally necessary.

Industry & Expert Opinions

🔹 Dr. Arvind Mehta, Economic Policy Expert:

“Privatization is not the only path to economic growth. If managed well, a strategic investment in PSUs can enhance competitiveness while ensuring national interests are protected.”

🔹 Ramesh Gupta, CEO, India Business Forum:

“Instead of just injecting funds, the government must introduce accountability measures to make these PSUs efficient and globally competitive.”

🔹 Labor Union Representative:

“This is a positive step. PSU workers have long been concerned about job losses under privatization. Government backing provides much-needed security.”

What’s Next? The Road Ahead

The government is likely to adopt a balanced model going forward. While certain loss-making PSUs may still be privatized, strategically significant ones will continue receiving state support.

Potential Future Actions:

- Performance-Based Funding: Government investments may be linked to efficiency metrics to ensure sustainability.

- Selective Privatization: While some PSUs will receive support, others may be gradually opened to private investors.

- Public-Private Collaboration: The government may encourage partnerships instead of complete divestment.

Conclusion

The shift from privatization to revitalization marks a pivotal moment in India’s economic policy. By focusing on strengthening state-run enterprises, the government is prioritizing economic resilience, employment, and infrastructure growth. However, the success of this strategy will depend on how effectively these investments translate into long-term improvements in PSU efficiency and competitiveness.

While this move safeguards national interests and workers’ livelihoods, it also raises questions about the sustainability of continued government intervention. The coming years will determine whether this approach helps build a stronger, self-sufficient Indian economy or requires further recalibration.